By Jane McClure

When 2024 “truth in taxation” notices start hitting mailboxes Nov. 11 and 24, St. Paul home owners could see a break. That’s even if their values increase. Property tax shifts and changes anticipated for next year move more of the property tax burden to commercial and industrial property taxpayers, said Ramsey County Assessor Patrick Chapman.

All of St. Paul’s residential neighborhoods were battered by the 2008 recession, with market values dropping. The recovery has been mixed, with some neighborhoods being slower to catch up than others. Frogtown is an area where the recovery has been slower. A piece of good news is that all of St. Paul’s neighborhoods have fully recovered from the recession’s downturn, Chapman said.

It will be a different story for commercial and industrial properties, as those sectors are seeing strong growth in market value. That’s a big factor propelling Ramsey County to a record of more than $74 million in property assessments. It also will have the impact of holding single-family residential property taxes down for many people.

Chapman noted that Ramsey County and St. Paul have a stable and growing property tax base. The county is at an all-time high in property assessments, at $74,212,604,200. St. Paul is also at an all-time high, at $35,288,806,700.

Countywide, the 2023 assessments and aggregate changes in assessed values tell a story and show trends expected to continue. The overall increase countywide is 6.26 percent for 2023. The greatest increase in aggregate market value is for industrial properties, at a 21.15 percent increase. Commercial properties have increased 8.23 percent, with apartments up 8.51 percent and residential properties up 4.26 percent. Part of the industrial market increase is driven by construction of flexible warehouse space construction, Chapman said.

In St. Paul, the overall 2023 increase was 5.44 percent. The highest increase was for industrial properties at 21.7 percent, followed by commercial properties at 9.03 percent, apartments at 7.76 percent and residential properties at 3.03 percent. Large projects including Highland Bridge and the Hillcrest/Heights development on the East Side have played a positive role, said Chapman.

“We’ve got some good development going on in the city of St. Paul,” Chapman said.

One caveat to strong market growth is the impact rising interest rates is having on the residential market, said Chapman. Low supply and high demand for housing are factors in growth in this market. But public officials are concerned that the housing affordability gap continues to widen.

The economic outlook remains solid for many real estate sectors, said Chapman, and softer for others. The industrial market is strong with few signs of weakening. The apartment market is showing signs of stabilizing after years of record growth.

The retail market remains in flux, with some parts of the county making a strong recovery from the COVID-19 pandemic and seeing high occupancy rates, Chapman said.

For St. Paul citywide, the median value home was at $266,300 in 2023, with a tax bill of $3,899. That home value increases to $267,400 for 2024, with an estimated tax bill of $3,832. That is a 1.7 percent or $67 decrease.

Levy increases would bring a $172 increase to the 2024 tax bill if the maximum levies are adopted. Changes and shifts in the property tax system, including fiscal disparities and homestead benefits, bring a net decrease of $239.

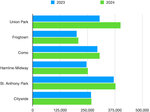

Three neighborhoods – downtown, Greater East Side and Payne-Phalen – will see market value decreases in 2024 for their median-value homes. Those decreases range from 3.6 percent in Payne-Phalen to 1.6 percent downtown.

The West End and West Side are the only neighborhoods with property taxes increases for their median homes, at 2.5 and 2.1 percent respectively.

Monitor area neighborhoods will all see median home values increase, yet taxes decrease.

What taxpayers pay depends on actual home value. Values can be affected by factors including comparable property sales in an area and if improvements have been made. The estimated taxes can vary, especially if levies are trimmed before year’s end. Levies can decrease but not increase after Sept. 30, under state law.

Comments

No comments on this item Please log in to comment by clicking here