By JAN WILLMS

Seeking support for the renovation of the former Sholom Home property at 1554 Midway Pkwy., an architect from Tanek and developers presented their case to the District 10 Como Community Council at its board meeting Feb. 21.

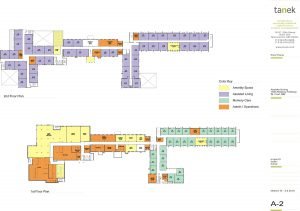

The plan is to convert the former nursing home into an assisted-living facility and also include 25 memory care units. To complete this project, tentatively called Como Park Senior Living, developers are seeking up to $18 million in tax-exempt bonds from the city’s Housing and Redevelopment Authority.

The property, which has stood vacant since 2009, has four buildings which will be gutted. Tim Van Houten (photo left), a project manager and designer for Tanek Architectural Design, said the original portion of the complex was built in the 1920s, and the exterior was amazingly intact. Van Houten said they want to lighten up the dark wood trim and bring it back to its original color. He said a fair amount of interior demolition has to be done.

The property, which has stood vacant since 2009, has four buildings which will be gutted. Tim Van Houten (photo left), a project manager and designer for Tanek Architectural Design, said the original portion of the complex was built in the 1920s, and the exterior was amazingly intact. Van Houten said they want to lighten up the dark wood trim and bring it back to its original color. He said a fair amount of interior demolition has to be done.

“We want to put in all new windows and move the large canopy from the front,” he said. “The rest of the complex was built in a series of stages through the 50s, 60s and 70s.”

“For the most part, we want to clean it up and not make major changes,” he noted. “We plan to use the two parking lots, but not expand them. They meet all zoning requirements.”

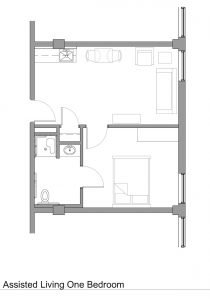

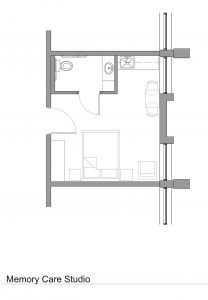

When last in use, the complex had 330 beds in it, with very small rooms. This was fairly typical of nursing homes, according to Van Houten. “We’re proposing to cut the number of beds in half.” He said the 25 studio-type memory units would have their own private outdoor area and meet all security protocols. The assisted-living units will feature one bedroom, a large bathroom, countertop and sink and general storage. “All meals will be served by the main kitchen,” Van Houten added.

He said the dining area is much larger than what is needed, and part of that space will be used for a game room and chapel, or multi-purpose media, whatever the needs are.

Van Houten said there will be sufficient parking for the staff; it is anticipated that few residents will have cars.

“The dead trees will be removed and new plantings put in,” he said.

David Grzan is CEO of developer Carlson CRE Group, LLC, and CEO of owner Charter Midway,LLC. He said they doing a quasi-early start. “We got a grant from the city of St. Paul for remediation, and we expect to start sometime in early March,” he stated. “We want to have the building asbestos-free, so we are starting that process independent of any financing or construction.” He said that from the time the owners close on the transaction, they are estimating about a year for construction and then will begin leasing. The lease-up mode should last from 12 to 24 months, with some of the first residents moving in the first and second month after construction finishes.

David Grzan is CEO of developer Carlson CRE Group, LLC, and CEO of owner Charter Midway,LLC. He said they doing a quasi-early start. “We got a grant from the city of St. Paul for remediation, and we expect to start sometime in early March,” he stated. “We want to have the building asbestos-free, so we are starting that process independent of any financing or construction.” He said that from the time the owners close on the transaction, they are estimating about a year for construction and then will begin leasing. The lease-up mode should last from 12 to 24 months, with some of the first residents moving in the first and second month after construction finishes.

Grzan told the Council that 80 percent of the units will be designated as affordable housing, with maximum rents for those units set at $891.The remaining units will have rents of around $2700.

Grzan told the Council that 80 percent of the units will be designated as affordable housing, with maximum rents for those units set at $891.The remaining units will have rents of around $2700.

“Almost all projects out there are being delivered for people who can pay their way,” he continued. “And for those who can’t, they are hard-pressed. There is no place for them to go.”

“Almost all projects out there are being delivered for people who can pay their way,” he continued. “And for those who can’t, they are hard-pressed. There is no place for them to go.”

He said the developer plans to be able to bring technologies to this project that no one else has. He said they hope to be able to monitor for falls, as well as provide physiological monitoring. “This will be a showcase not only for St. Paul but for the entire nation,” he commented. “We will provide the best health care at the lowest cost in a brand new facility.”

But to make this renovation a reality, the owner and developers are seeking tax-exempt bond financing from the city of St. Paul.

“This year, unlike in past years, there’s more demand for those bonds than there is availability,” said Stephanie Hawkinson, director of Housing Development with Landon Group. “The city has a limit on its authority to approve these bonds, and they are weighing out which projects will be funded and which ones will not be funded.”

“This year, unlike in past years, there’s more demand for those bonds than there is availability,” said Stephanie Hawkinson, director of Housing Development with Landon Group. “The city has a limit on its authority to approve these bonds, and they are weighing out which projects will be funded and which ones will not be funded.”

Hawkinson said that the tax-exempt bonds come with tax credits, which allows for the rents to be capped and remain affordable to seniors. “The tax credits come automatically with the bonds,” she said. This financing would provide half the funding necessary to convert the former nursing home into the assisted living complex.

“We respectfully are requesting you to express your support for this to City Council member Russ Stark since he is in a position to decide which bonds get approved and which do not. We want to make sure that this is one that gets funding,” Hawkinson said. The property is in Stark’s ward.

Grzan said his group has been carrying this project since December 2015. “A few owners before us attempted to do the same thing,” he noted. “What we found out is the marketplace isn’t really interested in financing this property. Banks don’t want to touch it, and preferred equity and investment bankers don’t want to touch it. We met with 90 sources from coast to coast, and they just don’t want to get involved. Part of it is dealing with a building that goes back 100 years. So here we are, working with the city of St. Paul to capture that tax-exempt bond financing that comes with taxable credits. It’s complicated, and there are a lot of moving parts, but it’s the only way we can shoehorn our way into this and get it done.”

In his 35 years of fundraising, Grzan said he had never come across a tougher project. “But we are happy to have the opportunity to have the city work with us,” he said.

Following a brief discussion, the Council voted to send letters of support for the bond financing for the project to City Council members Stark, Amy Brendmoen, and Dai Thao.

“The complex has been vacant for years, and we as neighbors would like to see the building rehabbed, jobs created, and our elderly residents stay in their community,” said District 10 Council Member Kevin Dahm.

Comments

No comments on this item Please log in to comment by clicking here